Employer Penalty Calculation Help

The New York State Workers' Compensation Law requires that employers provide Workers' Compensation coverage for their employees, with limited exceptions.

You have received a Workers' Compensation Penalty Notice because the Bureau of Compliance has no record of Workers' Compensation coverage for your business for the period identified on the notice. The Employer Penalty Calculation web application was developed to help employers understand the method used by the Workers' Compensation Board to determine penalties under section 52(5) of the New York State Workers' Compensation Law. An employer can use this application to find out how the penalty was calculated.

- Helpful Information:

- When moving from page to page always use the buttons on the page that contains the information. Do not use the browser toolbar "Back" and "Forward" buttons to navigate the pages.

- Getting Started:

- Locating the two identifiers you need to view your penalty calculation on the web:

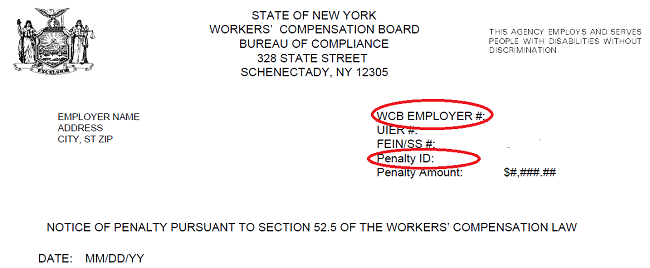

- WCB Employer # - Located in the upper right hand corner of the Penalty Notice, the WCB Employer # is a unique identifying number assigned to each employer by the Workers' Compensation Board. This number can be found on all correspondence sent by the Bureau of Compliance.

- Penalty ID - The Penalty ID is also located in the upper right hand corner of the Penalty Notice just below the WCB Employer #.

- Locating the two identifiers you need to view your penalty calculation on the web:

- Understanding Your Penalty Calculation

- Once you've submitted your WCB Employer # and Penalty ID, your penalty details will be displayed. The following information will be listed:

- WCB Emp Num (entered by you on the previous page) and Employer Name

- Penalty ID (entered by you on the previous page)

- From Date – The penalty start date

- To Date – The date through which this penalty is effective. If you are required to have a policy but continue to be uninsured, this date will be updated on a monthly basis. The penalty amount will also be increased.

- Total Penalty Days – The total number of days being penalized for this Penalty ID

- Total 10 Day Periods – The calculation is based on periods of 10 days; this is the total number of 10 day periods

- There have been law changes over the years that affect penalty rates, so you may see multiple subtotals if your penalty spans more than one rate period.

- For each rate period, the following information will be displayed:

- Rate Effective Date – The date the penalty rate became effective

- Penalty Period Begin Date - End Date – The date range for which your penalty is being assessed at this rate

- Rate Per 10 Day Period – The rate at which each 10 day period within the penalty period is assessed

- Number of 10 Day Periods Assessed @ [Rate] – The number of 10 day periods in your penalty for which the above rate is effective

- Number of Employees Used – For penalty periods beginning December 1, 2013, rates for section 52.5 penalties became dependent upon the number of employees on record for the employer; this is only relevant for penalties where the penalty's "To Date" is after December 1, 2013. The rates for these penalties are listed below:

# of Employees Rate Per 10 Day Period 5 or less $500 6-10 $750 11-24 $1,000 25 or more $2,000 - The penalty subtotal for the rate period is determined by multiplying the rate dollar amount by the number of 10 day periods. This is displayed under the Total column.

- At the bottom of the page, the grand total for the penalty is displayed.

- Please Note: Subsequent subjectivity or coverage activity may have changed the penalty dates and total from the issuance of your penalty notice.

- Once you've submitted your WCB Employer # and Penalty ID, your penalty details will be displayed. The following information will be listed:

-

Contact Information:

- If you experience problems using the Employer Penalty Calculation web application:

- Contact the Bureau of Compliance at ( 866 ) 298-7830 Monday - Friday, 8:30 A.M. to 4:30 P.M. if:

- You are having difficulty understanding what information you need to complete.

- You are having difficulty understanding any messages or Help statements in the application.

- You are unsure what the directions are telling you to do.

- Contact the Help Desk with any other technical issues.

- Contact the Bureau of Compliance at ( 866 ) 298-7830 Monday - Friday, 8:30 A.M. to 4:30 P.M. if:

- If you experience problems using the Employer Penalty Calculation web application: